Six years ago, I had my “I’m sick and tired moment”. Sick and tired of what? I was sick and tired of paying student loans, I was sick and tired of having credit card debt, I was sick and tired of car payments, and I was sick of tired of being tied to the bad financial decisions of the past.

It was time to focus on a plan to become debt free. Thankfully, I had a starting point way back in 2010 when I took Dave Ramsey’s Financial Peace University at my church. At the time, I was a single mom working in corporate America, and the tools and resources provided were great, I began working towards debt freedom, by starting with cutting up my credit cards.

BUT life happens and next thing you know I am asking for new cards to be sent and opening new accounts as well. Fast forward, to 2015 I am now married with two daughters, and back to the “sick and tired of debt” feeling. I saw a friend’s post on Facebook that she had paid off her student loans. She was the first person that I knew who actually paid off student loans. That single post sparked a fire within me to really focus on paying off all our debt minus our house.

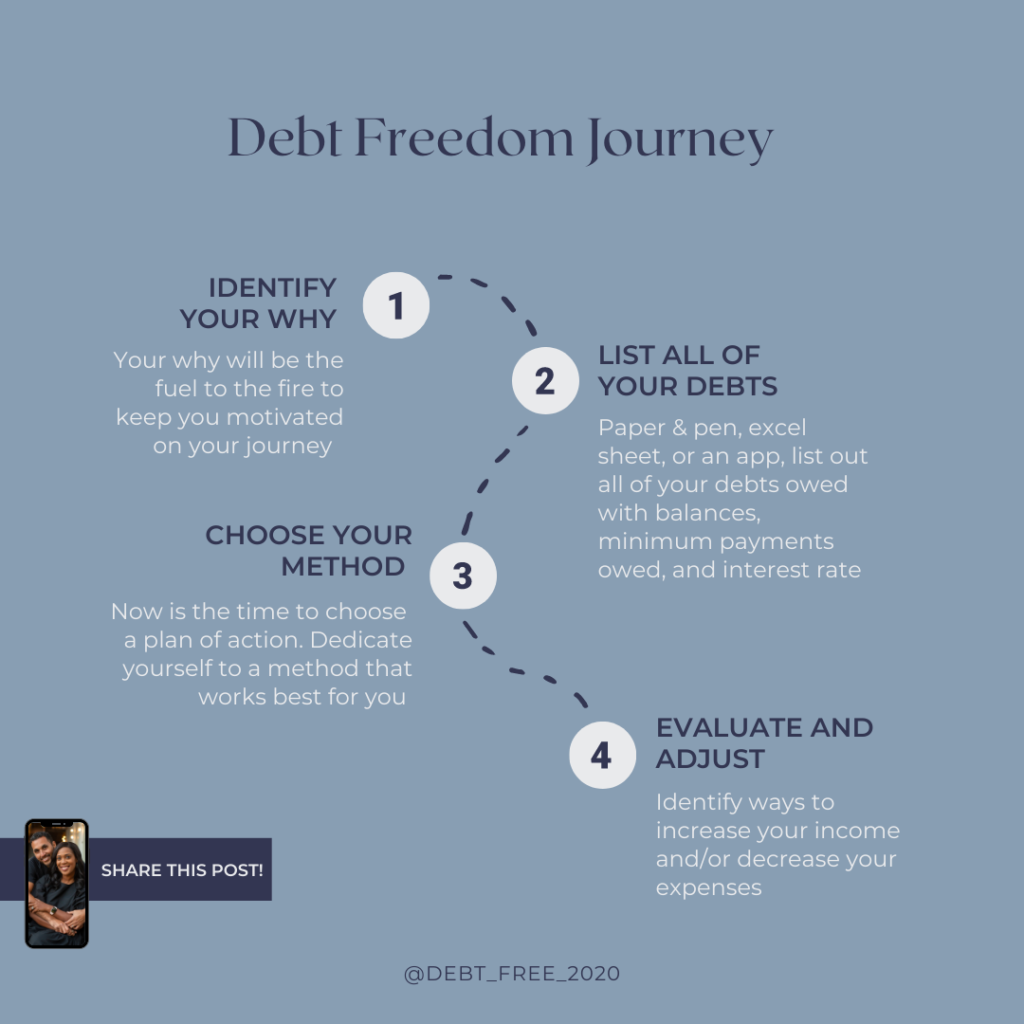

The Process

My husband (DJ) and I sat down, and I let him know it was time to get serious about our finances. Our bills were paid on time, we had good credit, but we were drowning in $137,000 worth of debt. I was sick and tired!

We decided we would tackle our debt together. None of this you pay on your debts and I pay on my debts. We are now married which means we are now one in the eyes of our God. Therefore, your debts are mine and my debts are yours.

Since I had already attended Dave Ramsey Financial Peace University classes, we mostly followed his seven baby steps towards financial freedom. Dave Ramsey 7 Baby Steps:

- Baby Step 1: Save $1,000 emergency fund

- You may think this is too small of an emergency fund and it is but it is just a starting point

- Baby Step 2: Pay off all your debts minus the house using the debt snowball method

- There are several methods to paying off debt, but I personally like the snowball method because the small wins kept me motivated while on our 59-month journey towards debt freedom.

- Baby Step 3: Three to six months of expenses in a fully funded emergency fund

- Currently where we are in our journey.

- Baby Step 4: Invest 15% of your household income into retirement

- We’ve both made increases to our contribution percentages to capitalized on the match our employers provide.

- Baby Step 5: Save for your children’s college fund

- Bay Step 6: Pay off your home early

- Baby Step 7: Build wealth and give.

- Live and give like no one else

We created an excel spreadsheet that listed our debts from least to greatest and began to tackle those debts. Our smallest debt was $300 with our largest debts being $40k+. It was a good source of knowing where our starting and finish lines were. As we started paying off and cancelling out debts.

The Need for Additional Income – Side Hustles

We were making progress with our plan diligently managing our monthly income and debt, but it was not moving as fast as I wanted. Basically, all extra monies after paying bills was going towards the next debt on our spreadsheet. So, I did the unthinkable and decided to get a part-time side hustle. My husband did not believe me at the time, that I would do it BUT I did it for a year! It wasn’t a fun and glamourous side hustle either! I was waiting tables at a local restaurant called Alamo Café. Here I am in my thirties, with a full-time career and waiting tables again like I am in college. But I didn’t care, I was there for one reason only, to get out of debt. I kept a running ledger in my apron at Alamo Café, as a reminder why I was there. My managers, co-workers, and sometimes customers knew why I was there, to pay off debt.

If you are wanting to get out of debt and would like to bring in some additional income, look into different side hustles that can bring in additional income. Here are just a few side hustle ideas:

- Create a blog

- Create an Etsy Shop

- Uber Driver

- Door Dash delivery

- Favor Delivery

- Instacart

- Consulting

- Drop shipment business

- Waitress

- Retail (DJ worked at part time at Home Depot for a year while I worked at Alamo Café)

Those are just a few but you can always turn your talents or passion into a side hustle too. After a year we quit Home Depot and Alamo Café and kept pushing along our journey. Then again, in 2019 as we were finishing up the final stretch of our debt free journey, we decided to hustle one last time to complete the process. We jumped into new side hustles by delivering for Favor and Door Dash.

Finally, after 59 months of grinding, hustling, juggling careers, family, kids, and sometimes 5 jobs at once between the both of us we paid off more than $137k worth of debt. The process was not easy at all but totally worth it!

Key things that helped us get through this journey was:

- Break down goals into smaller Milestones.

- Reward ourselves when we complete milestones.

- We kept things in our budget that we enjoyed (pedicures, hair appointments, golfing, etc.)

- Lastly when we got tired, we learned how to rest but not quit the process.

Visuals

I am big on setting goals and visuals. So, determine what your financial goals will be this year and make it visual. Put in a place that you will see daily. My visuals sit in a corner in my bathroom. I listed out all the remaining debts we were working on at the time, I had a letter board for my annual goals, and I had a vision board to help keep me encouraged.

For anyone who is needing an extra push to pay off your debt THIS IS THAT MOMENT! As we begin a new year let this be the last year that you are drowning or carrying debt. Make a plan that works for you and your household, stick to a budget, and focus on paying off your debts.

This is so inspiring and encouraging.

We’re already debt free— praise the Lord!

Even so, your practical steps and instruction to be organized, disciplined, and setting aside immediate gratification for lasting joy are tools I can use to accomplish my goals!

Thank you for sharing your story!

Blessings on all your endeavors!!!

You all started off on the right track at becoming debt free at such a young age! I love that!

Thanks so much!