I am not prepared mentally or financially to send my daughter to college in three years.

Getting mentally prepared is not the hard part but being financially prepared is something I should have started to save for 15 years ago when she was born. But it’s never to let to get started.

Time on not on my side to send my oldest daughter to college with enough money to cover the expenses, but I do have time on my side for my youngest daughter.

I decided to stop waiting for the perfect moment to start. It used to be once I get my tax return, I would invest $1,000 to start her college savings. Then it was when I get a bonus, when I pay off debt, when I complete a 6-month emergency fund, or once I learned everything I needed to know about 529 accounts I would start.

Well, I still do not know everything I need to know, I am learning as I go, but now both of my daughters have 529 college savings accounts. Will Syd have $100k in her account in 3 years when she starts college? No, but she will have something. Will my youngest have $100k in 12 years? There is a good chance that I will have that saved for her, but “Will it be enough” is the question?

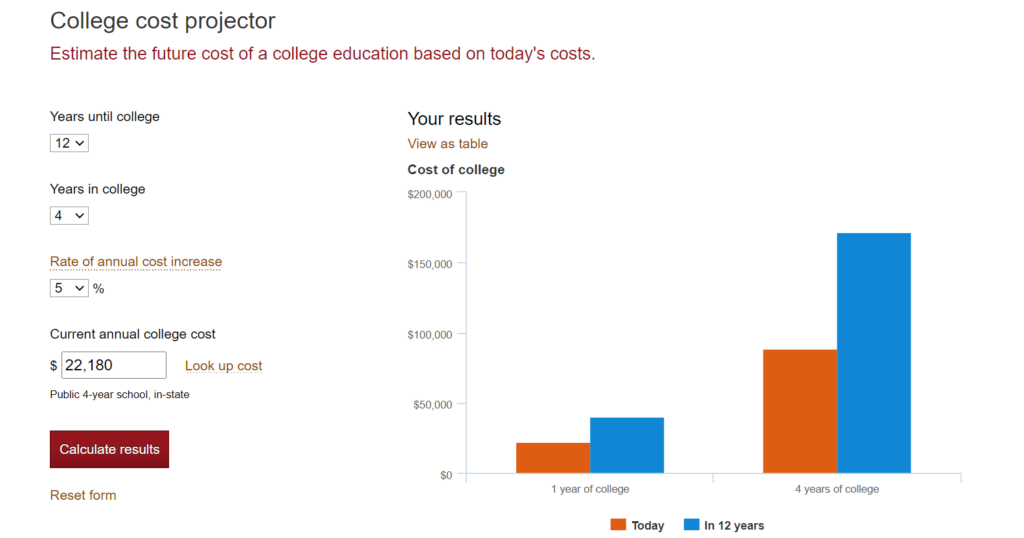

According to Vanguard’s College Cost Projector, it’s estimated that it will cost $171,682 to send my youngest to an in-state, public college for four years.

Don’t let the fear of the unknown stop you from saving for your children’s higher education. There are a few ways you can save for your child’s higher education. But for the purpose of this blog, I am going to focus on 529 College Savings Plans.

When to start saving?

The best time to start saving for your child’s education is as soon as possible, like when they are still in the womb. If you choose to go this route, you will open a 529 account in your name and then transfer the account to your child once the child is born and have a social security number.

If you are starting later in life, like me, again its ok but we just don’t have the opportunity of compound interest to work its magic.

Where do I start?

First, do your research! I am still in this phase all though I already opened an account because I was tired of waiting for the right time.

Research which states offer the best 529 plans. I live in Texas, but my 529 account is held by Kansas. Check out https://www.savingforcollege.com/college-savings-201 to compare plans and benefits offered. Not all plans are great plans so that is where your research is needed.

Common things you want to look at when researching 529 college savings plans is:

- Fees & expenses

- Tax incentives

- Contribution limits

- Investment options

For example, I had planned to open a 529 savings plan with Vanguard, but their enrollment fee was $3,000 just to open an account. That would have given me another reason to continue delaying opening an account, so I went with a brokerage that didn’t have a minimum enrollment fee.

Where do I open a 529 College Savings Plan?

Depending on the state plan you select you may be limited to certain brokerages. But you can open a 529 college savings plan at any of the following plus many more:

How do I contribute to a 529 College Savings Plan?

This is the easy part! Set up reoccurring automatic contributions. Just like saving for anything else in life auto contributions is the best. Out of sight out of mind.

When you get a pay raise put a portion of that money towards your own retirement and a portion towards kid’s future.

What if….

Are you thinking what if my child doesn’t go to college?

That is fine, you can change the beneficiary. Switch it to another child, future grandchild, or you can use for advancing your education.

What if my child receives a scholarship?

If your child receives a scholarship, you may withdraw that exact amount from a 529 plan and use it for anything without incurring a penalty on earnings, but you will have to pay taxes on the earnings.

What if I don’t have anything saved up for my own retirement? Should I contribute to a 529 plan?

Stop reading. Save this for later and go contribute at least to the company match for your retirement.

You need to make sure you are taken care of first.

Because I took out several thousand dollars in student loans is the reason, I am focused on making sure my daughters’ education is paid for. My commitment to them is I will take care of their undergrad but if they want a master’s degree then they are own their own. Hopefully without any student loan debt.

Learn more about 529’s on Instagram by following @Aunt. Kara, @Danielle_Invests, and @KidsMoneyAcademy.